A stress free process

For most people, buying or selling a house is the largest transaction they will ever deal with. Fairbrother & Darlow aim to ensure that each sale or purchase is as stress free as possible and that you are kept up to date with the process throughout.

Legal terms

Standards

The Law Society’s Conveyancing Quality Scheme (CQS) provides a recognised quality standard for residential conveyancing practices. Membership establishes a level of credibility for firms with stakeholders such as regulators, lenders and insurers as well as residential homebuyers and sellers.

We are proud to have achieved the standards of practice and integrity required to be accredited by the Law Society’s Conveyancing Quality Scheme. This scheme’s logo is your guarantee that our practice will provide you with a professional and quality conveyancing service in accordance with the scheme rules.

Get in touch

Contact us with details of your move now and we will provide you with:

What happens when you buy or sell a property?

This is a general summary of what happens during a conveyancing transaction. Each transaction however is different and if you have any questions at any time, please call us.

Telephone: 01344 310 865

DON'T ENTER ANY TITLE OR CONTENT IN HERE

Your content goes here.

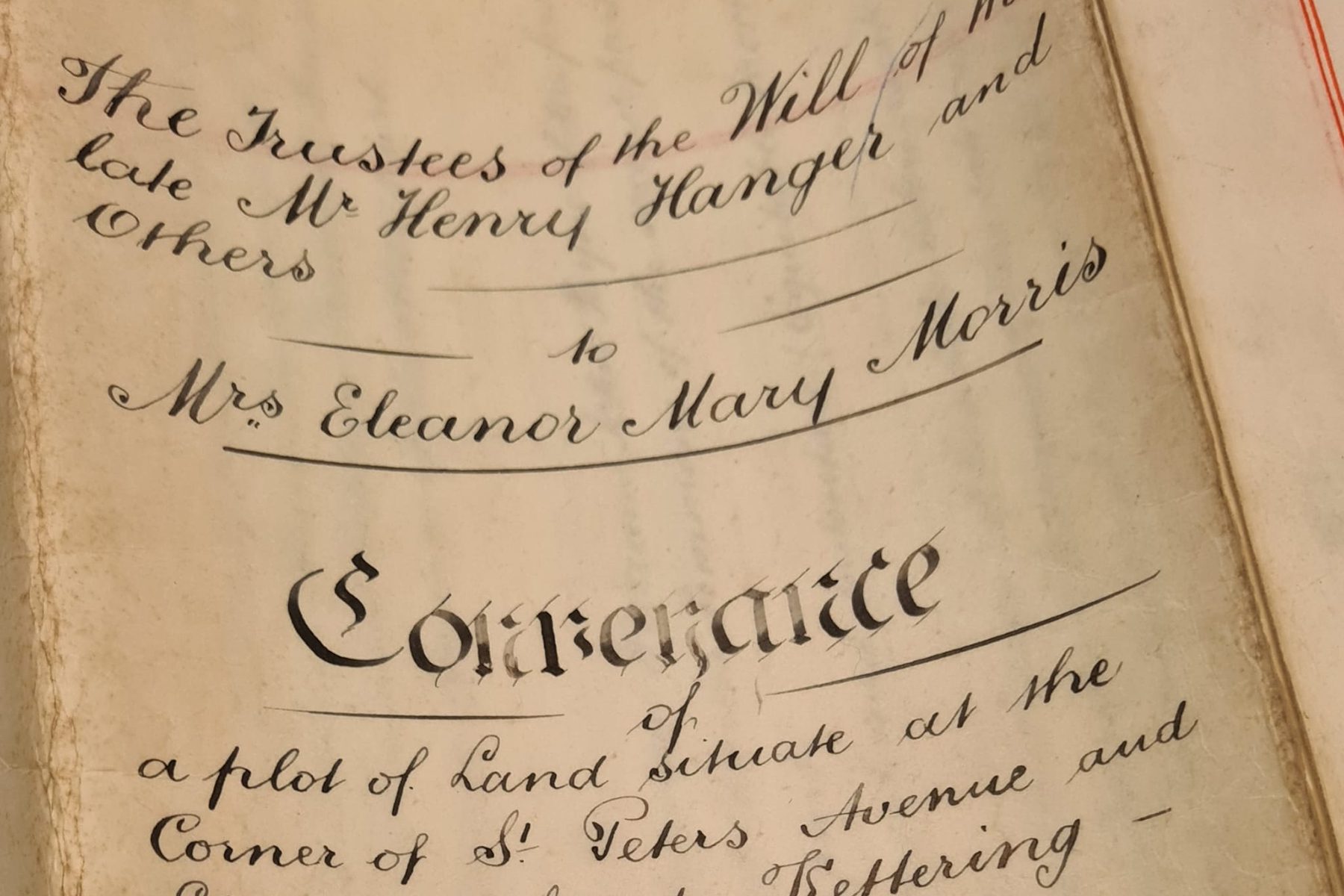

Title Deeds

Traditionally, the term ‘Title Deeds’ referred to the bundle of deeds and documents that proved you owned a house. This information is now usually held electronically at the Land Registry and we obtain up to date information when you start to sell your house. Any other relevant documents should have been given to you when you bought the house. We will therefore ask you to let us have any documents about your house that you hold. This will include all the certificates, planning consents and guarantees that you may have received if you have had work carried out at the house.

Property Information Form and Contents Schedule

You will be sent a property information form to fill in giving as much information about your house as possible. It is important that you fill this in carefully as your buyers will rely on the information given. You will also be asked to provide supporting paperwork, such as electrical or window certificates. The Contents Schedule will list the items you will include in the sale, and make clear which items you intend to remove.

Drafting the Contract

Once we have your completed forms and title deeds, we will prepare a draft Contract. This will be sent to the buyer’s solicitor along with the other information you have supplied and copies of your ‘Title’ from the Land Registry.

Additional Enquiries

The buyer’s solicitor will look at the paperwork we supply and may require some additional information from us and from you. It may be that answers you completed on the property information form require more detail or that the results of their searches have prompted additional questions. At this stage, we may need to obtain the additional information from outside sources, such as a local authority or insurance company.

Approve draft contract

When the buyer’s solicitor is happy with all the information they will send back the draft Contract approved, ready for you to sign.

Sign the Contract

We will arrange for you to sign the contract as soon as possible. If there is a dependant purchase we will make sure that the two transactions are tied in.

Exchange of Contracts

When you have signed your contract and (if relevant) your proposed purchase is ready, we will inform the buyer’s solicitor that you are ready to exchange contracts. The Completion Date (the date on which the buyer pays for the property and gets the keys) needs to be agreed before exchange of contracts can take place as that will form part of the agreement.

When both parties are ready to commit to the transaction, the contract that you have signed and the contract that your buyers have signed are literally ‘exchanged’. Once contracts have been exchanged, you and the buyers are legally committed to buy and sell the property. Failure to do so at this stage will result in the party at fault being in breach of contract.

Completion Date

The agreed completion date is the date upon which you must vacate the house and the buyer can take up occupation, having first paid the balance of the purchase price. Failure to complete will result in the party at fault being in breach of contract and financial penalties may apply. If you have a mortgage, it will be paid off from the sale proceeds before you receive the balance. If you are also buying a new home, then that transaction will be completed as soon as your sale has completed.

Contacting the Seller’s Solicitors

We will firstly write to the seller’s solicitors requesting;

- Draft contract

- Property Information Forms

- Fixtures and fittings list

- Title Information

If it is a leasehold property we will also ask for a copy of the lease, 3 years management accounts (if applicable) and a current buildings insurance policy.

Enquiries

As soon as we receive the draft contract and other paperwork, we will examine it carefully and raise any questions that we feel are necessary.

Searches

We have to make enquiries of other organisations about the house or flat.

- Local Search

- Drainage Search

- Environmental Search

- Chancel Enquiries

These are all necessary to make sure that there is nothing that will affect your enjoyment of the property. It will check that all necessary planning permissions have been obtained. It will check that you have mains drainage and water supply. It will make sure that the land below the house is not contaminated in some way.The searches go further than this and you will get copies of all results as part of the transaction.

The searches go further than this and you will get copies of all results as part of the transaction.

Mortgage Offer

As well as acting for you, we will act for the bank or building society offering you your mortgage. We will need formal instructions from the lender before we can exchange contracts. We also have to comply with their requirements and we may have to tell them if there is any issue about the title to the property.

Report

Once we are satisfied that the paperwork is all in order, we prepare a detailed report about the house or flat, containing all relevant documents and searches. We will explain to you all of the information that has been received and the responsibilities you will have as an owner and a borrower. We always prefer to meet face to face when possible. It is at this time that you will be asked to sign the contract and other paperwork

Pricing Guide

Get in touch

Call us on 01344 310 865